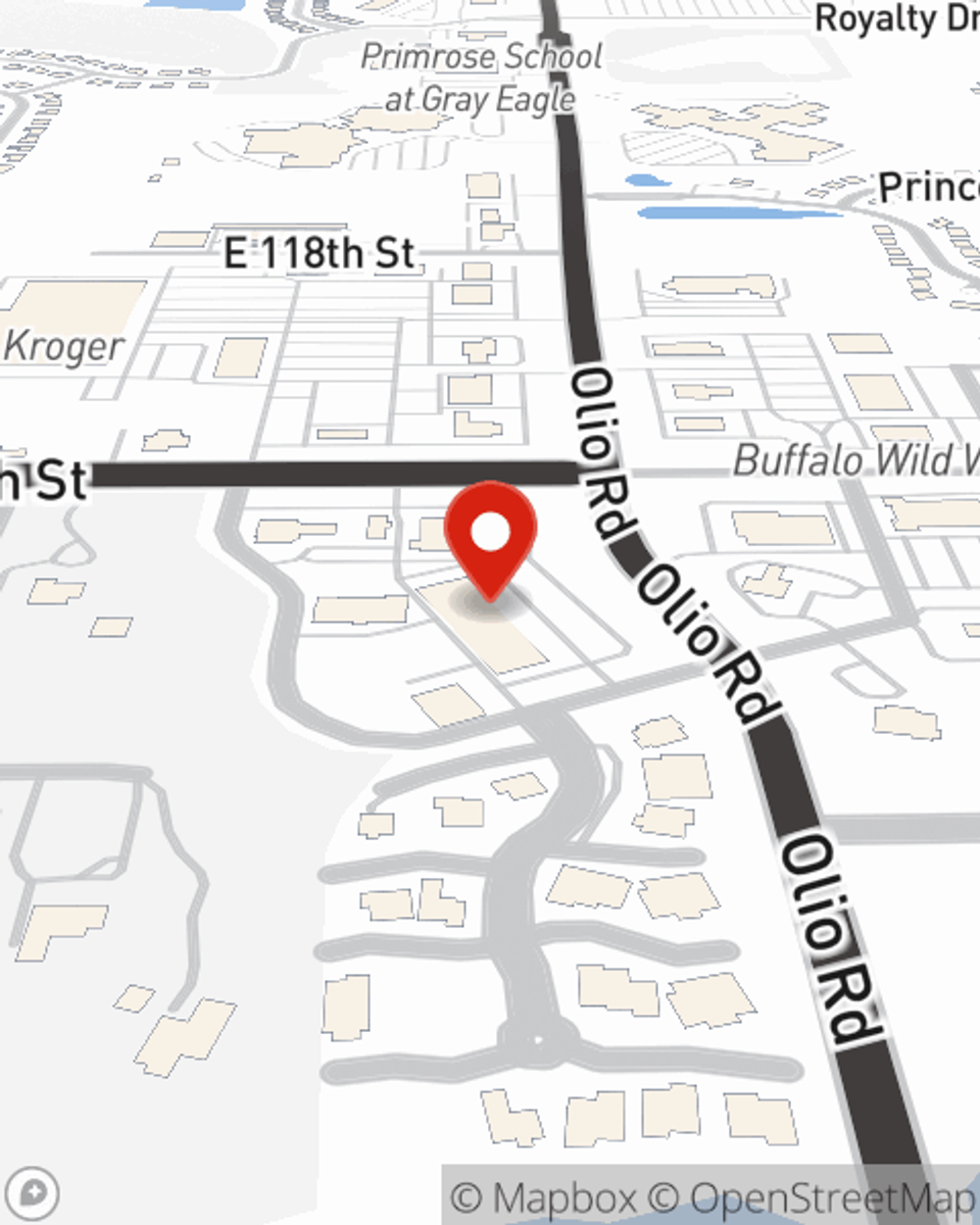

Business Insurance in and around Fishers

Calling all small business owners of Fishers!

Helping insure businesses can be the neighborly thing to do

- Fishers

- Noblesville

- McCordsville

- Geist

- Hamilton County

- Carmel

- Westfield

- Fortville

- Ingalls

- Hancock County

Coverage With State Farm Can Help Your Small Business.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Problems happen, like a staff member gets hurt on your property.

Calling all small business owners of Fishers!

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like errors and omissions liability or extra liability, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does arise, agent Chris Berger can also help you file your claim.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Chris Berger today to research your business insurance options!

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Chris Berger

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.